Joint Liability Loans

Joint Liability Loans

BHUMISKY has adopted a unique Joint Liability Group (JLG) lending model, designed to provide financial support to individuals seeking income generation and growth. Under this model, a small group of individuals collectively avails loans, with each member sharing equal responsibility for repayment through a formal agreement. This ensures financial discipline, mutual accountability, and a structured approach to credit accessibility for underserved communities.

Typically, beneficiaries of the JLG model are engaged in similar economic activities across agriculture, allied sectors, and non-farm enterprises, enabling them to leverage collective growth and financial security. Since its inception, this loan product has been one of BHUMISKY’s core financial offerings, playing a crucial role in empowering rural and semi urban entrepreneurs by providing them with access to much needed capital.

BHUMISKY integrates modern technology into the Indian Microfinance sector to enhance efficiency, accessibility, and transparency in credit distribution. Our approach bridges the gap between the informal credit system known for its flexibility and responsiveness and the formal financial institutions, which offer technical expertise, administrative support, and strong financial backing. By blending these strengths, BHUMISKY ensures that the credit needs of economically vulnerable individuals are met in a sustainable and socially responsible manner.

Through the JLG model, BHUMISKY aims not only to provide financial assistance but also to foster an environment of economic resilience, self sufficiency, and long term financial independence for individuals and communities across India.

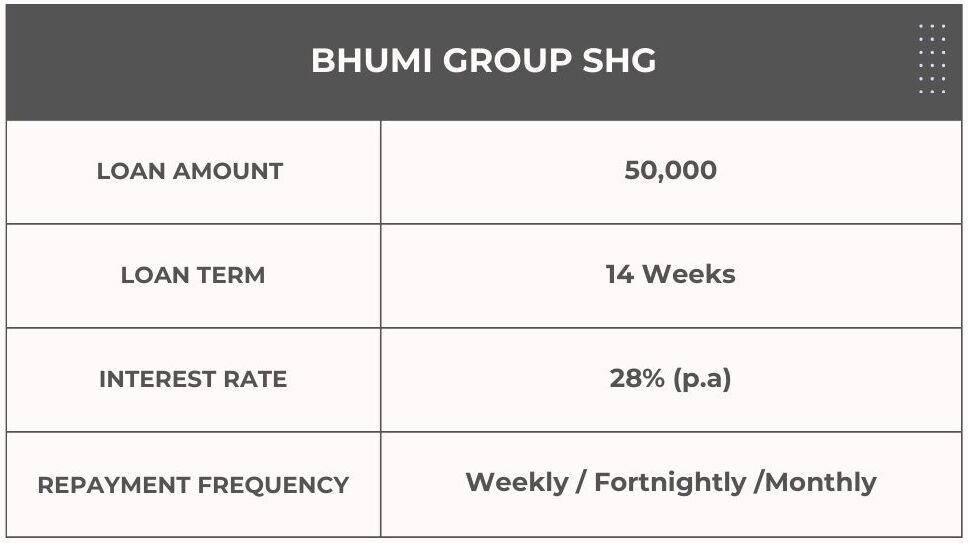

BHUMI GROUP SHG

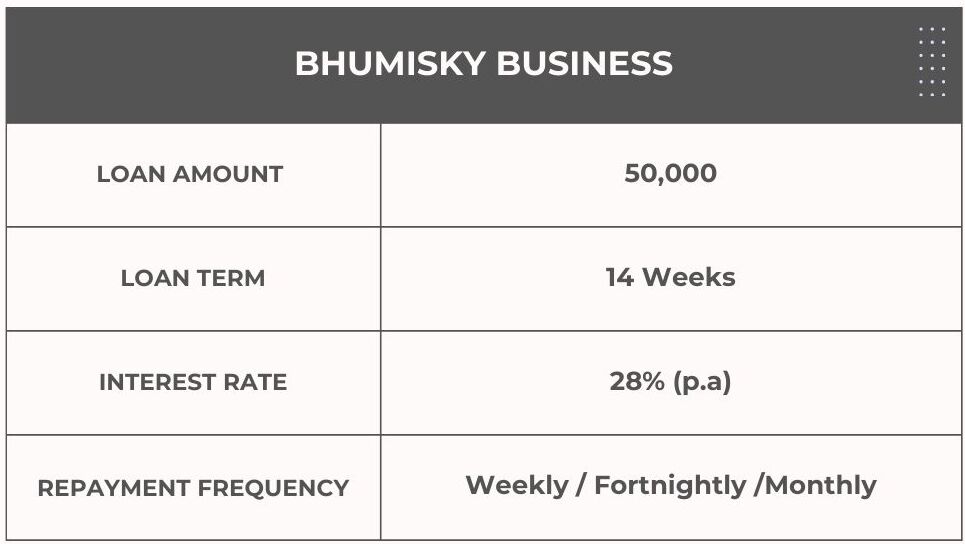

BHUMISKY BUSINESS

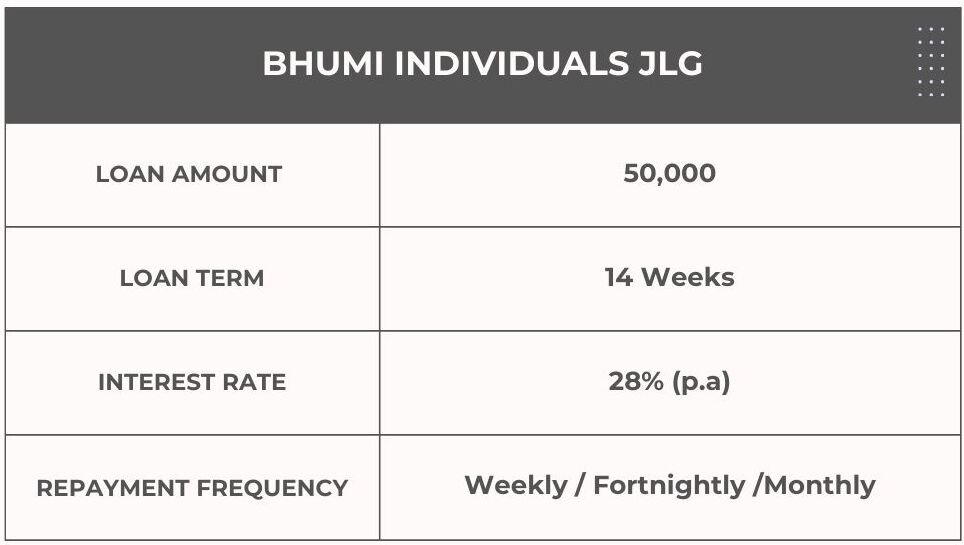

BHUMI INDIVIDUALS JLG